Forex Trading Strategy & Education During London Session

What is the London session in forex?

London Session/European Forex Session

Just when Asian market/Tokyo Session participants are starting to close Business, Traders/Participants in European Forex Session Or London Session are just beginning their day.

While there are several financial centers all around Europe, it is London that market participants keep their eyes on.

Historically, London has always been at a center of trade, It's no wonder that it is considered the Forex capital of the world with thousands of businessmen making transactions every single minute. About 30% of all forex transactions happen during the London session.

Facts about European Session/London Session:

- The London forex session is one of the most liquid trading sessions.

- Due to the high volume of buying and selling, major currency pairs can trade at extremely low spreads.

- Due to the large amount of transactions that take place, the London trading session is normally the most volatile session.

- Most trends begin during the London session, and they typically will continue until the beginning of the New York session.

- Day traders looking to target short moves may be interested in finding trends and breakouts to trade so as to reduce the cost they pay in spreads.

- Trends can sometimes reverse at the end of the London session, as European traders may decide to lock in profits.

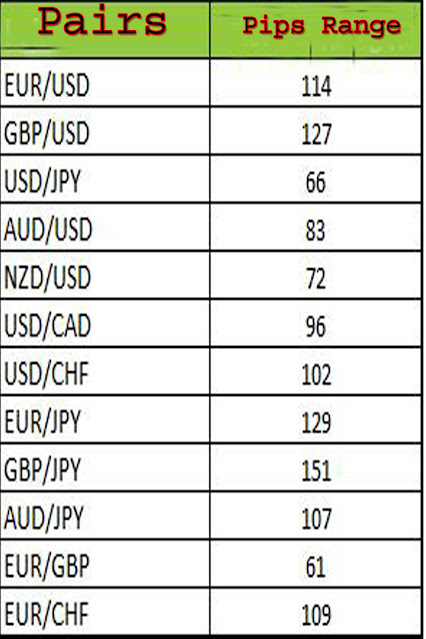

Below is a table of the London session pip ranges of the major currency pairs.

Which Pairs Should You Trade in European Forex Session/London Session?

Because of the volume of transactions that take place in London Session, there is so much liquidity during the European session that almost any pair can be traded.

But, it may be best to Trade in the major Pairs like;(EUR/USD, GBP/USD, USD/JPY, and USD/CHF), as these normally have the tightest spreads.

These pairs are also normally directly influenced by any news reports that come out during the European session.

You can also try the yen crosses (more specifically, EUR/JPY and GBP/JPY), as these tend to be pretty volatile at this time. Because these are cross pairs, the spreads might be a little wider though.

What pairs are most volatile during London session?

The most volatile among them are GBP/JPY, EUR/JPY and GBP/USD. These are pairs for the risk-tolerant traders, as their high volatility offer plenty of trading opportunities and large profit potential in a short period of time.

Which forex pairs move during London session?

Best currency pairs to trade during the London session. Major currency pairs include the GBP/USD, EUR/USD, USD/JPY, and USD/CHF. These normally have the tightest spread and the highest potential profits.

May 10, 2021

Tags :

Forex Session

No Comments