Major Forex Trading Sessions from Around the World

What are sessions in forex?

Typically, the market is separated into three sessions during which

activity is at its peak and which comprise the 24-hour market: the

Asian, European and North American sessions. More commonly, these three

periods of

Forex trading hours

are known as the Tokyo, London, and New York sessions.

Tokyo Session

The opening of the Tokyo session at 12:00 AM GMT marks the start of the

Asian session. You should take note that the Tokyo session is sometimes

referred to as the Asian session because Tokyo is the financial capital of

Asia.

One thing worth noting is that Japan is the third largest forex trading

center in the world.

This shouldn't be too surprising since the yen is the third most traded

currency, partaking in 16.50% of all forex transactions. Overall, about

21% of all forex transactions take place during this session.

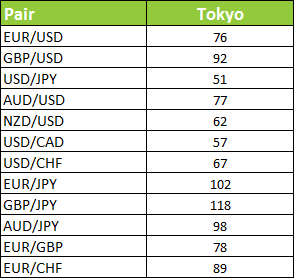

Best pairs for Tokyo and Sydney session

Below is a table of the Asian session pip ranges of the major currency pairs.

Take note that these are NOT ABSOLUTE VALUES and can vary depending on

liquidity and other market conditions.

Here some key characteristics that you should know about the Tokyo

session:

• Action isn't only limited to

Japanese shores. Tons of forex transactions are made in other financial

hot spots like Hong Kong, Singapore, and Sydney.

• The main market participants

during the Tokyo session are commercial companies (exporters) and

central banks. Remember, Japan's economy is heavily export dependent

and, with China also being a major trade player, there are a lot of

transactions taking place on a daily basis.

• Liquidity

can sometimes be very thin. There will be times when trading during this

period will be like fishing - you might have to wait a long, long time

before getting a nibble.

• It is more likely that you will

see stronger moves in Asia Pacific currency pairs like AUD/USD and

NZD/USD as opposed to non-Asia Pacific pairs like GBP/USD.

• During those times of thin

liquidity, most pairs may stick within a range. This provides opportunities for

short day trades or potential breakout trades later in the day.

• Most of the action takes place

early in the session, when more economic data is released.

• Moves in the Tokyo session

could set the tone for the rest of the day. Traders in latter sessions

will look at what happened during the Tokyo session to help organize and

evaluate what strategies to take in other sessions.

• Typically, after big moves in

the preceding New York session, you may see consolidation during the

Tokyo session.

Which Pairs Should You Trade in Tokyo Session?

Since the Tokyo session is when news from Australia, New Zealand, and

Japan comes out, this presents a good opportunity to trade news events.

Also, there could be more movement in yen pairs as a lot of yen is

changing hands as Japanese companies are conducting business.

Take note that China is also an economic super power, so whenever news

comes out from China, it tends to create volatile moves. With Australia

and Japan relying heavily on Chinese demand, we could see greater

movement in AUD and JPY pairs when Chinese data comes in.

Best Forex Pairs in the Tokyo session

You can make useful combinations like JPY/USD, AUD/JPY, EUR/JPY, NZD/USD,

NZD/JPY. These options are better for investors that are looking for high

volatility in the Forex market during the Tokyo session.

Next Read:

London Session,

New York Session.

Session Overlap.

May 05, 2021

Tags :

Forex Session

No Comments