Forex Market Liquidity and Volatility and Size

What Is a Liquid Market?

A liquid market a one with many available buyers and sellers and

comparatively low transaction costs. The details of what makes a market

liquid may vary depending on the asset being exchanged. In a liquid

market, it is easy to execute a trade quickly and at a desirable price

because there are numerous buyers and sellers and the product being

exchanged is standardized and in high demand. In a liquid market despite

daily changes in supply and demand the spread between what the buyer wants to pay and what sellers

will offer remains relatively small.

What Is illiquid and Thin Market?

Illiquid refers to the state of a stock, bond, or other assets that

cannot easily and readily be sold or exchanged for cash without a

substantial loss in value. Illiquid assets may be hard to sell

quickly because there is low trading activity or interest in the

issue, indicated by a lack of ready and willing investors or

speculators to purchase or sell the asset. As a result, illiquid

assets tend to have lower trading volume, wider bid-ask spreads, and greater price

volatility.

Market Size and Liquidity

Unlike other financial markets like the New York Stock

Exchange, the Forex market has neither a physical location

nor a central exchange.

nor a central exchange.

The Forex market is considered an Over-the-Counter (OTC), or "Inter

bank", market due to the fact that the entire market is run

electronically, within a network of banks, continuously over a

24-hour period.

This means that the spot Forex market is spread all over the

globe with no central location. They can take place anywhere.

The Forex OTC market is by far the biggest and most popular

financial market in the world, traded globally by a large number

of individuals and organizations.

In the OTC market, participants determine who they want to trade

with depending on trading conditions, attractiveness of prices,

and reputation of the trading counterpart.

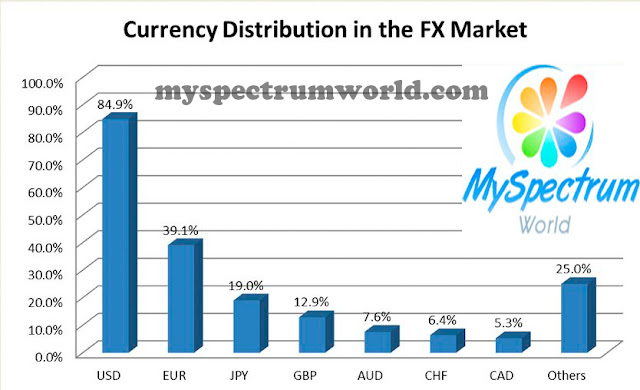

The dollar is the most traded currency, taking up 84.9% of all

transactions. The euro's share is second at 39.1%, while that of

the yen is third at 19.0%. As you can see, most of the major

currencies are hogging the top spots on this list!

Here is Chart:

Currency distribution in Forex(FX) market

The Dollar is King

If the USD is one half of every major currency pair, and the

majors comprise 75% of all trades, then it's a must to pay

attention to the U.S. dollar. The USD is king!

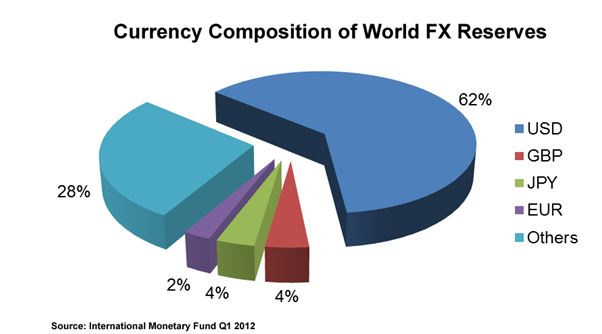

In fact, according to the International Monetary Fund (IMF),

the U.S. dollar comprises roughly 62% of the world's official

foreign exchange reserves! Because almost every investor,

business, and central bank own it, they pay attention to the

U.S. dollar.

Reasons why the U.S. dollar plays a central role in the Forex market:

1-The United States economy is the LARGEST economy in the world.2-The U.S. dollar is the reserve currency of the world

.

3-The

markets in the world.

4-TheUnited States

4-The

5-The United States

The U.S. dollar is the medium of exchange for many cross-

The U.S. dollar is the medium of exchange for many cross-

border transactions. For example, oil is priced in U.S.

dollars.

So if India wants to buy oil from Saudi Arabia

bought with U.S. dollar. If India doesn't have any dollars, it

has to sell its Rupee first and buy U.S. dollars.

No Comments