Bid and Ask - Definition, Example, How it Works in Trading

All forex quotes are quoted with two prices: the bid and ask. For the most

part, the bid is lower than the ask price.

The bid is the price at which your broker is willing to buy the

base currency in exchange for the quote currency. This means the bid is

the best available price at which you (the trader) will sell to the

market.

The ask is the price at which your broker will sell the base

currency in exchange for the quote currency. This means the ask price is

the best available price at which you will buy from the market.

Another word for ask is the offer price.

The difference between the bid and the ask price is popularly known as the

spread.

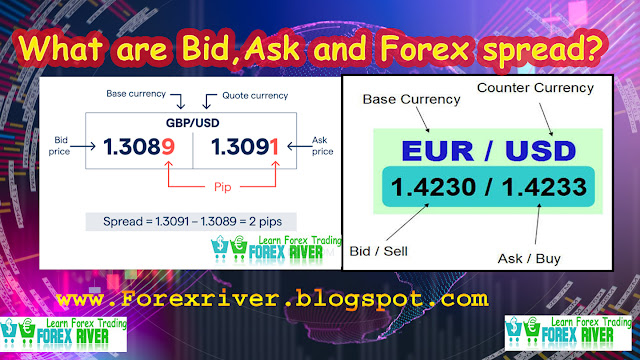

On the GBP/USD quote above, the bid price is 1.3089 and the ask price is

1.3091. Look at how this broker makes it so easy for you to trade away

your money.

ASK-BID == (1.3091-1.3089=2 Pips)

Spread is 2 Pips.

If you want to sell GBP, you will sell Pounds at BID Price 1.3089.

If you want to buy GBP, you will buy Euros at ASK 1.3091.

Spreads can either be wide (high) or tight (low) – the more pips derived

from the above calculation, the wider the spread. Traders often favor

tighter spreads, because it means the trade is more affordable.

Example of Bid/Ask in Forex Trading:

EUR/USD

In this example, the euro is the base currency and thus the "basis" for

the buy/sell.

If you believe that the U.S. economy will continue to weaken, which is

bad for the U.S. dollar, you would execute a BUY EUR/USD order. By doing

so, you have bought euros in the expectation that they will rise versus

the U.S. dollar.

If you believe that the U.S. economy is strong and the euro will weaken

against the U.S. dollar you would execute a SELL EUR/USD order. By doing

so you have sold euros in the expectation that they will fall versus the

US dollar.

What is Long/Short in Forex Market?

First, you should determine whether you want to buy or sell.

If you want to buy (which actually means buy the base currency and sell

the quote currency), you want the base currency to rise in value and

then you would sell it back at a higher price. In trader's talk, this is

called "going long" or taking a "long position."

Just remember: long = buy.

If you want to sell (which actually means sell the base currency and buy

the quote currency), you want the base currency to fall in value and

then you would buy it back at a lower price. This is called "going

short" or taking a "short position". Just remember: short = sell.

What is Last Price in Forex Market?

It could be the bid price or the ask price, but most precisely, it is

the price fixed after a mutual agreement between the bidder and the

seller.

Next Read:

What Is Margin In Forex Trading? How To Calculate Margin For Forex Trades|Margin Requirment

May 16, 2021

Tags :

Forex Basics

,

Forex Strategies

No Comments