What is Margin Trading in Forex?

Margin Trading in Forex is a Small Part of Money from Your

Investment, that Broker or Third Party undertake with him.

You are only required to put up a small amount of Money Known as "Capital"

to open and maintain a new position, Trade or Lot.

This capital in Forex Market is known as the margin.

Margin in Forex Trading can be understood of as a good Trusted deposit

Money or collateral that’s needed to open a position or Lot and keep it open

with Broker.

Simply "Margin in Forex Trading" is a part of your Investment

that your forex broker sets apart from your account balance to keep your

trade or Lot open and to ensure that you can away from the Unrealized

loss of the trade.

Margin is Free when the trade or Lot is closed, Your Capital/Money/ in

shape of Margin is back into your forex trading account. Now you can use

that Free Margin to open New Trades or Lots.

What is Margin Requirement and How to Calculate Margin in Forex

Trading?

In forex, it would be just as foolish to buy or sell 1 euro, so they

usually come in "lots" of 1,000 units of currency (Micro), 10,000 units

(Mini), or 100,000 units (Standard) depending on your broker and the

type of account you have Open.

"But I don't have enough money to buy 10,000 euros! Can I still trade?"

You can with margin trading!

Margin trading is simply the term used for trading with borrowed

capital. This is how you're able to open $1,250 or $50,000 positions

with as little as $25 or $1,000. You can conduct relatively large

transactions, very quickly and cheaply, with a small amount of initial

capital.

Explanation of Margin Trading:

You believe that Forecast in the market are indicating that the British

pound will go up against the U.S. dollar.

You open one standard lot (100,000 units GBP/USD), buying with the

British pound at 2% margin and wait for the exchange rate to

climb.

When you buy one lot (100,000 units) of GBP/USD at a price of 1.50000,

you are buying 100,000 pounds, which is worth US$150,000 (100,000 units

of GBP * 1.50000).

If the margin requirement was 2%, then US$3,000 would be set aside in

your account to open up the trade (US$150,000 * 2%). You now control

100,000 pounds with just US$3,000.

Your Forecast come true and you decide to sell. You close the position

at 1.50500. You earn about $500.

Calculation; How Margin Calculated.

|

What You Do

|

GBP

|

USD

|

|

You buy 100,000 pounds at the exchange rate of 1.5000

|

+100,000

|

-150,000

|

|

You blink for two seconds and the GBP/USD exchange

rates rises to 1.5050 and

you sell.

|

-100,000

|

+150,500

|

|

You have earned a profit of $500.

|

0

|

+500

|

When you decide to close a position, the deposit that you originally

made is returned to you and a calculation of your profits or losses

is done.

This profit or loss is then credited to your account.

What is Margin Requirement in Forex Market?

Required margin is explained as a specific amount of your

account’s currency.

Margin requirement in forex is simply the percentage

amount that a broker sets, which determines how much margin is

required for a trader to open a new position.

The amount of margin in Forex Trading needed to open a position

Differ, Depending on the currency pair and forex broker,

Margin amount requirements demonstrated as: 0.25%, 0.5%, 1%, 2%,

5%, 10% or higher.

This percentage (%) is known as the Margin Requirement.

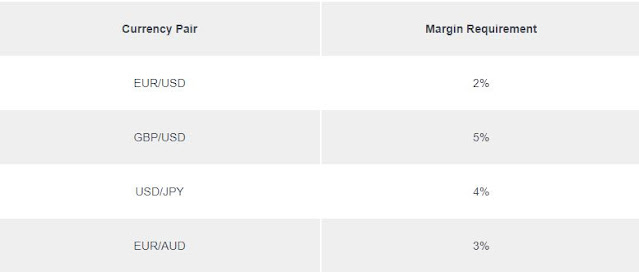

Examples of margin in Forex Trading requirements for several

currency pairs:

What is Margin Calculator and how It works:

Margin calculator helps you calculate the margin needed

to open and hold positions.

Enter your account base currency, select the currency pair and

the leverage, and finally enter the size of your position in

lots.

The calculation is performed as follows:

Required Margin = Trade Size / Leverage * Account

Currency Exchange Rate

Example:

Volume in Lots: 5 (One Standard Lot = 100,000 Units)

Leverage: 100

Account Base Currency: USD

Currency Pair: EUR/USD

Exchange Rate: 1.365 (EUR/USD)

Required Margin = 500,000 /100 * 1.365

Required margin is $6825.00 USD

No Comments