What is Forex (FX) Ladder

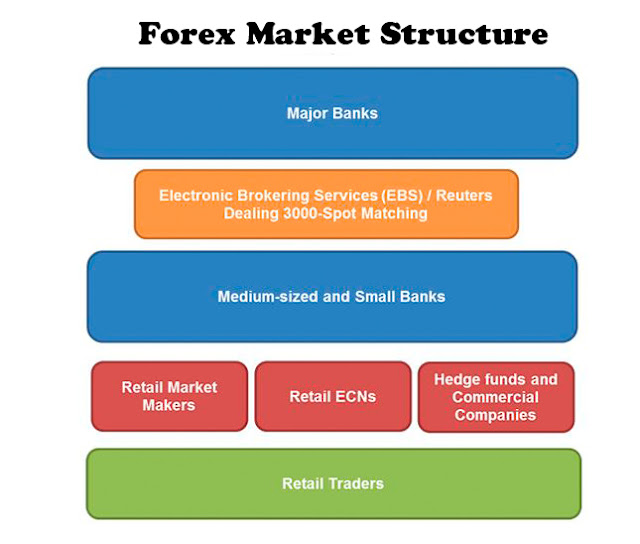

Even though the Forex market is decentralized, it isn't pure and utter chaos! The participants in the FX market can be organized into a ladder. To better understand what we mean, here is a neat illustration:

What is market structure/Market Hierarchy in Forex?

Market structure is simply support and resistance on your charts, swing highs, and lows. These are levels on your chart attracts the most attention.And how you can combine candlestick patterns with market structure is that you are basically looking to enter your trades after strong price rejection.

Forex (FX) Ladder|Forex Market Structure

The main participants are the large international banks, financial centers around the world, brokers and speculators. The forex market structure hierarchy is divided basing on the classification of participants, their motivation, regulations and the level of liquidity they hold at each level.

At the very top of the Forex market ladder is the interbank market. Composed of the largest banks of the world and some smaller banks, the participants of this market trade directly with each other or electronically through the Electronic Brokering Services (EBS) or the Reuters Dealing 3000-Spot Matching.

The competition between the two companies - the EBS and the Reuters Dealing 3000-Spot Matching - is similar to Coke and Pepsi.

They are in constant battle for clients and continually try to one-up each other for market share. While both companies offer most currency pairs, some currency pairs are more liquid on one than the other.

For the EBS plaform, EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid.

Meanwhile, for the Reuters platform, GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD are more liquid.

All the banks that are part of the inter-bank market can see the rates that each other is offering, but this doesn't necessarily mean that anyone can make deals at those prices.

Like in real life, the rates will be largely dependent on the established CREDIT relationship between the trading parties.

It's like asking for a loan at your local bank. The better your credit standing and reputation with them, the better the interest rates and the larger loan you can avail.

Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs.

Since these institutions do not have tight credit relationships with the participants of the inter-bank market, they have to do their transactions via commercial banks. This means that their rates are slightly higher and more expensive than those who are part of the inter-bank market.

At the very bottom of the ladder are the retail traders. It used to be very hard for us little people to engage in the Forex market but, thanks to the advent of the internet, electronic trading, and retail brokers, the difficult barriers to entry in Forex trading have all been taken down. This gave us the chance to play with those high up the ladder and poke them with a very long and cheap stick.

Now that you know the Forex market structure.

No Comments