What is a Lot in Forex?

A lot in Forex trading basically refers to the size of a trade or the amount/number of trades that a trader willing to trades at any given time.

Lots Can Also be Define as:

The number of currency units you will buy or sell. When you place orders on your trading platform, orders are placed in sizes quoted in lots.

Forex lots and the terms allover lot trading is widely used still among almost all of the top trading brokers in the sector.

Why Lots used in Forex Market?

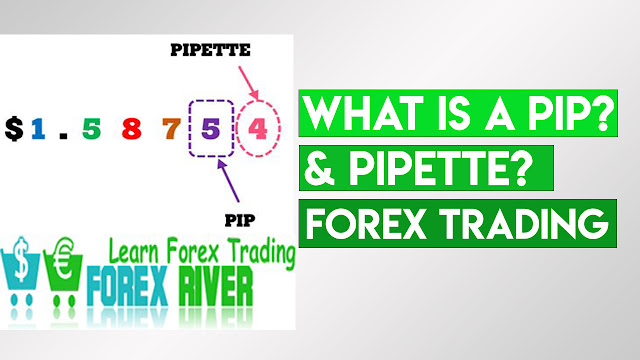

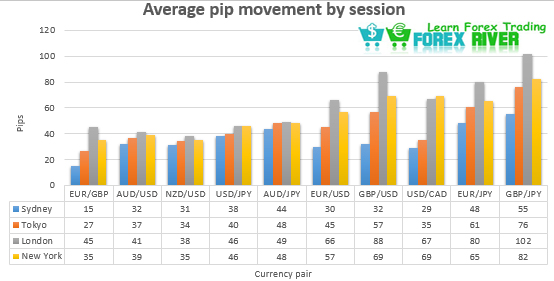

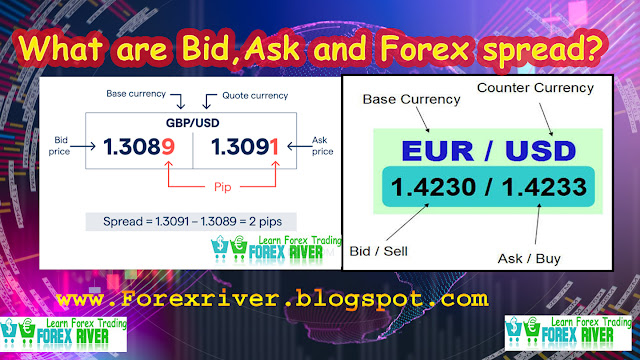

As you may definitely know, the adjustment of Currency esteem comparative with another is estimated in "pips," which is an extremely, little level of a unit of money's worth. To exploit this moment change in esteem, you need to trade large amounts of a particular currency in order to see any Crucial profit or loss.

How Many Types of Lots in Forex Market?

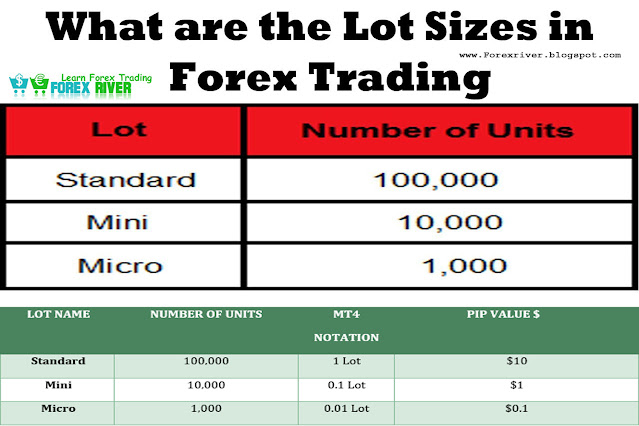

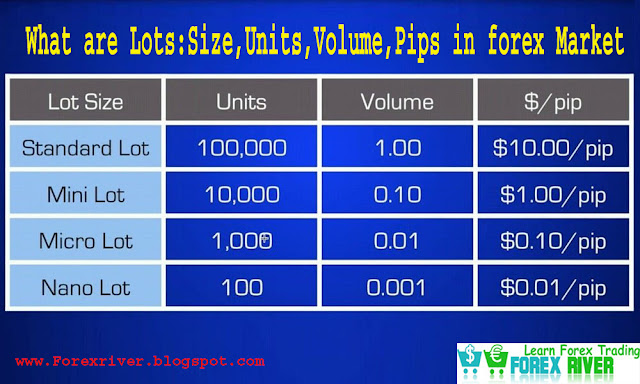

There are 4 main types of Lots: Standard Lot, Mini Lot, Micro Lot, and Nano Lot. Standard Lot:

Chart of "Types of Lots in Forex Market"

A standard lot represents 100,000 units of any currency.

A one-pip movement for a standard lot corresponds with a $10 change.

Example:

If the EURUSD exchange rate was $1.3000, one standard lot of the base currency (EUR) would be 130,000 units. This means, at the current price, you’d need 130,000 units of the quote currency (USD) to buy 100,000 units of EUR.

What is Mini Lot?

A mini lot is a currency trading lot size that is one-tenth the size of a standard lot of 100,000 units, or 10,000 units. One pip of a currency pair based in U.S. dollars is equal to $1.00 when trading a mini lot, compared to $10.00 when trading a standard lot.

Mini lots are common lot sizes in forex mini accounts that can be opened with some forex broker dealers.

Mini lots are commonly used by beginners that are new to the market and learning how to trade.

Example:

If the EURUSD exchange rate was $1.3000, one mini lot of the base currency (EUR) would be 13,000 units. This means, at the current price, you’d need 13,000 units of the quote currency (USD) to buy 10,000 units of EUR.

What Is a Micro-Lot?

A micro lot in forex trading is 1,000 units of the base currency in a currency pair.

A micro lot allows for smaller positions and/or greater fine-tuning of position sizes than a mini or standard lot.

Investors use micro-lot when they prefer not to trade mini or standard lots. Ten micro lots equal one mini lot (10,000 units), and 10 mini lots equal one standard lot which is 100,000 units of the base currency.

Example:

If the EURUSD exchange rate was $1.3000, one micro lot of the base currency (EUR) would be 1300 units. This means, at the current price, you’d need 1300 units of the quote currency (USD) to buy 1000 units of EUR.

What is a Nano-Lot?

Nano lots are even smaller, at one-tenth the size of a micro lot One pip of a currency pair based in U.S. dollars is equal to just $0.01 when trading a Nano lot.

Example:

If the EURUSD exchange rate was $1.3000, one Nano lot of the base currency (EUR) would be 130 units. This means, at the current price, you’d need 130 units of the quote currency (USD) to buy 100 units of EUR.

What Lot Size Should I Trade?

You need to calculate lot size or position size based on your equity, risk, and trade probability.

The best lot size for forex is based on equity size. Usually, recommended lot size in forex Is equal to 1% account risk.

The most simple strategy is to calculate position size in lots is:

Calculate the size of the lot based on equity

Example:

You can set 1 mini lot per $5000 or 1 micro lot per $500 (the gold standard for new traders or lot size forex recommendation). So based on your equity you can calculate position size.

What Lot Size Should I Trade as a beginner trader?

If the trading account is funded in U.S. dollars, a micro lot is worth $1,000; 1 pip would be equal to around 10 cents. Beginner’s trader position size should be 1 micro lot ($1000 worth) for each $500 in account size. For example, if your account has $10 000, the approximate position size should be 2 mini lots (1 micro lot x 20=20 micro-lots = 2 mini lots).

How to Calculate Lot Size in Forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

To calculate risk percentage for trade using account balance, traders can define risk in dollars per position trade.

What information do we need to make a forex position size calculator formula?

Account Currency: USD

Account Balance: $5000 for example

Risk Percentage: 1% for example

Stop loss: 200 pips, for example

Currency: EURUSD

How to find a lot of size in trading?

In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: Calculate risk in dollars.

Calculate Risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: Calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: Calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the Position Size Calculator.

In MT4, calculate lot size using a lot size calculator. If you know your risk, you can calculate lot size using the calculator below:

Lot size calculator|Position Size Calculator|Risk Calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size: