What is Leverage in Forex Trading Market?

Leverage in Forex is effectively just a short-term, Conceptual

loan.

It is Conceptual in the sense that you don’t physically receive a loan – it’s simply an

automatic credit line Widen by your broker in respect of your forex

trades.

This will normally be Contain of a degree of security money, known as

margin, which usually accounts for a certain ratio of the trade, with the

remainder being comprised of leverage funding.

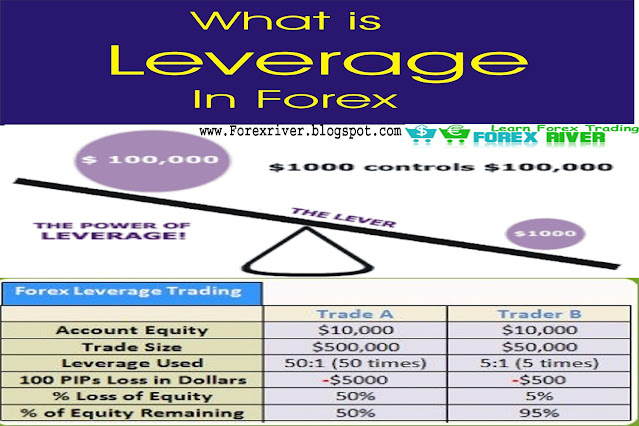

More About Leverage in Forex: As you are thinking about, how a small

investor can trade such large amounts of money.

Think of your broker as a bank who basically fronts you $100,000 to buy

currencies.

All the bank asks from you is that you give it $1,000 as a trusted

deposit, which he will hold for you but not necessarily keep. Sounds too

good to be true? This is how forex trading using leverage works.

The amount of leverage you use will depend on your broker and what you

feel comfortable with.

Typically the broker will require a trade deposit, also known as "account margin" or "initial

margin."

Once you have deposited your money you will then be able to trade. The

broker will also specify how much they require per position (lot) traded.

For example, if the allowed leverage is 100:1 (or 1% of position

required), and you wanted to trade a position worth $100,000, but you only

have $5,000 in your account. No problem as your broker would set aside

$1,000 as down payment, or the "margin," and let you "borrow" the rest. Of course, any losses or gains will be

deducted or added to the remaining cash balance in your account.

The minimum

security (margin)

for each lot will vary from broker to broker. In the example above, the

broker required a one percent

margin. This means that for every $100,000 traded, the broker wants $1,000 as a

deposit on the position.

What is the best leverage to use in forex?

leverage of 1:100 in Forex is the best leverage to be used in forex

trading. Leverage of 1:100 means that with $500 in the account, the

trader has $50,000 of credit funds provided by the broker to open

trades.

Most forex brokers allow a very high leverage ratio, or, to put it

differently, have very low

margin requirements. This is why profits and losses change high in forex trading

even though currency prices do not change all that much — certainly not like

stocks. Stocks can double or triple in price, or fall to zero; currency

never does. Because currency prices do not change Significantly, much lower

margin requirements are less risky than it would be for stocks.

Note, however, that there is Sizeable risk in forex trading, so you may be

point to

margin calls when currency exchange rates change Quickly.

How Does Leverage Work in Forex Trading?

With 100:1 leverage a trader can open a position 100 times greater than

they could without leverage.

For example:

If the cost to purchase .01 lots of EUR/USD is normally $1000 and the

broker offers 100:1 leverage, then the trader must put up only $10 as

margin. Of course, the trader can use as little leverage as they want.

Why is leverage dangerous?-Risk in Leverage in Forex Trading

Higher leverage means higher risk. Most professionals use a very low

leverage ratio, or none at all, and a modest risk percentage per trade.e.g.

a trade that can be entered using $1,000 of trading capital, but has the

potential to lose $10,000 of trading capital).

Leverage and Margin Calculator in Forex Trading Market:

How to Use the Forex Margin Calculator?

Currency pair: In this field traders can select from several Major

Forex crosses, some Minor pairs, from the most popular cryptocurrencies

versus the USD (BTC, ETH, LTC, Stellar and Ripple), and Gold/Silver versus

the USD. For our example, let's choose the EUR/USD.

Deposit currency: Margin values are different for each Forex pair,

or any other financial instrument, and subject to its current market quote.

By selecting the deposit currency, it will be possible to accurately display

the margin amount of the selected instrument in the trader's account base

currency (from AUD to ZAR). We will choose GBP as our deposit currency, for

this example.

Leverage: In this field traders just need to input their current

leverage, offered by their broker, or they can choose from a range of 1:1

to a maximum of 600:1 to simulate the amount of margin used to open a

position with different leverage options. For our example, we will select

a leverage of 30:1.

Lots (trade size): Simply type in the lot size. Remember, one

standard lot of a Forex pair is 100,000 units per 1 lot, but units per 1

lot vary for the non-forex pairs. In this field there's also the option of

switching between lots or units for the calculations. For our example, we

will use a trade size of 0.10.

Next, we click the "Calculate" button.

The results: Using all the formulas illustrated above, and the data

supplied, the Forex Margin Calculator tell us that to open a trade

position, long or short, of a 0.10 lot EUR/USD, with a 30:1 leverage

trading account, and with the current EUR/GBP exchange rate of 0.90367, we

would need a margin of £ 301.22.

The Forex Margin Calculator can also be used to find the least "expensive"

pairs to trade. For the same example above, and by using the same

calculating parameters (30:1 leverage and a 0.10 lot trading position), if

instead of selecting the EUR/USD we choose the AUD/USD, then we see that

the margin required would be much less, only 186.89 GBP.

No Comments